State Active Duty Improvements Lead to Higher Pay for National Guard

By Col Wayde Minami

BALTIMORE, Md. – One of the unique aspects of National Guard service is the different duty statuses in which members can serve. Unlike their counterparts in the active components, National Guard members could be on active duty, inactive duty or state active duty – commonly referred to as SAD.

Federal active duty has long been considered the most lucrative pay status because military members receive prorated portions of their base pay as well as the basic allowance for housing (BAH) and basic allowance for subsistence (BAS) based on the number of days served. In inactive duty status, members only receive their base pay without BAH or BAS.

Pay for members on SAD varies from state to state, depending on state law. In some states, SAD pay rates haven’t kept up with current military pay scales. But in others, that is changing, especially for lower-ranking members.

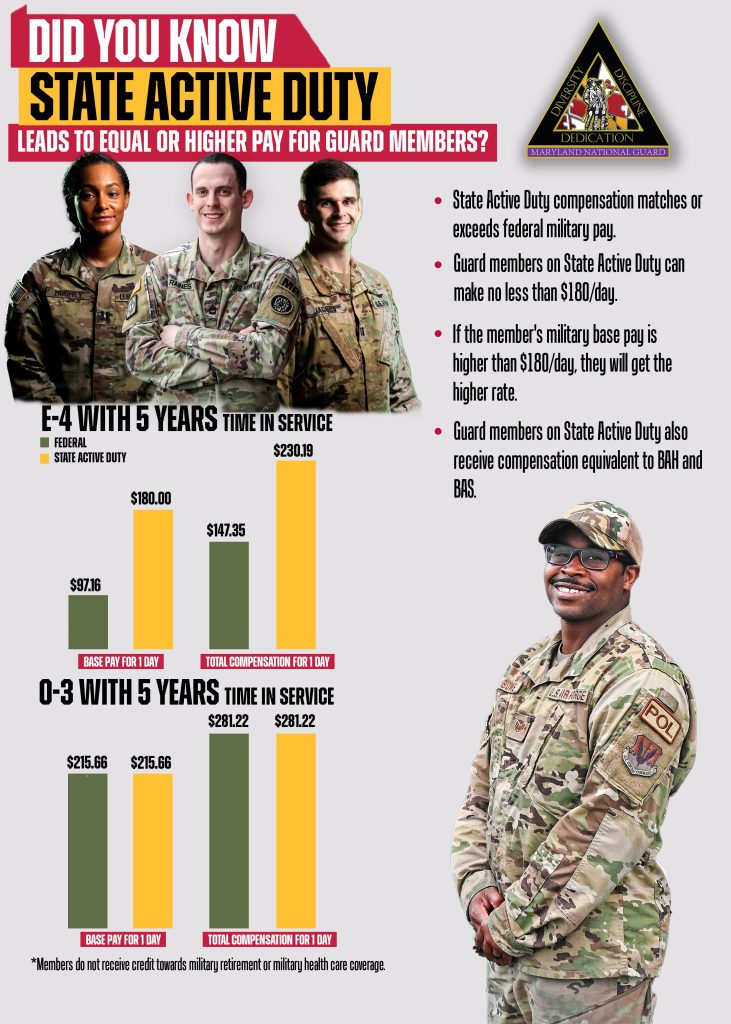

In the Maryland National Guard, for example, an E4 with five years in service earns almost twice as much on state active duty as he or she would in federal active-duty military pay: $180 per day in base pay for SAD versus $97.16 on federal duty. In addition, the service member would earn an identical amount – $50.19 per day – for housing and subsistence, whether on SAD or federal active duty.

“In the past, state active duty had this reputation of being inadequate. Today, if you look at the numbers, it’s the opposite,” said Brig. Gen. Amy Kremser, director of the Maryland National Guard Joint Staff. “In fact, for much of our enlisted force, SAD pay is considerably higher than what they would earn in any other military pay status.”

This is a reflection of state minimum wage laws. In Maryland, National Guard members are technically considered state employees while on state active duty. Maryland Guard members on SAD can be paid no less than 12 times the state minimum wage (currently $15 an hour) for each day of SAD service, or $180 per day.

Even for higher-ranking members, SAD compensation has improved substantially. In Maryland, if a member’s normal military base pay is more than $180 per day, they receive the higher rate of pay. This is a quantum improvement over decades past, when SAD pay was a fixed amount specified in laws that hadn’t been updated for many years.

Maryland National Guard members also receive an additional amount based on what they would have received in BAH and BAS. As a result, compensation while on state active duty generally matches the total of base pay and allowances the member would receive while on federal active duty.

Example 1: E4 with 5 years time in service

-Base pay for 1 day of federal active duty: $97.16

-Base pay for 1 day of state active duty: $180.00

-BAH/BAS for 1 day: $50.19

-Total SAD pay for 1 day of state active duty: $230.19

-Total Military pay for 1 day of federal active duty: $147.35

Example 2: O3 with 5 years time in service

-Base pay for 1 day of federal active duty: $215.66

-Base pay for 1 day of state active duty: $215.66

-BAH/BAS for 1 day: $65.66

-Total SAD pay for 1 day of state active duty: $281.22

-Total Military pay for 1 day of federal active duty: $281.22

The Maryland National Guard, which recently established a number of enduring cyber defense positions on SAD and are also considering establishing a larger standing force on state active duty, want to ensure members are aware how much state active duty compensation has changed.

“These new positions are part of a paradigm shift in how we use members on SAD, employing them proactively instead of just in emergency response mode,” Kremser said. “Ensuring they receive appropriate compensation on SAD is essential to making that possible.”

Maryland Guard officials noted that there are some differences between SAD and federal active duty unrelated to pay. For example, because they are technically state employees while on SAD, members are covered by state workman’s comp rather than the military medical system. By the same token, retirement points towards a federal military retirement are not accrued on SAD because members are considered state employees during the duty.