GIVE Maryland Gets Face-Lift, New Website Makes Community Investment Tax Credit Program More Accessible to Donors

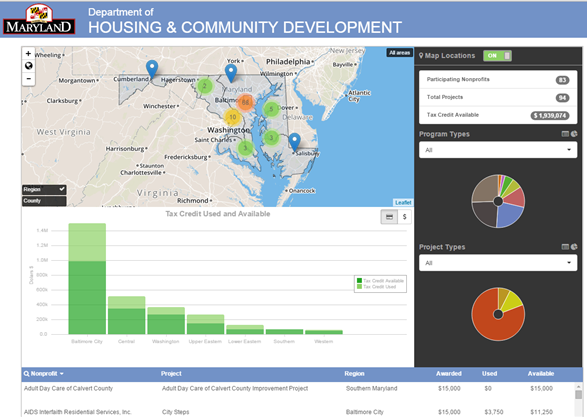

GIVE Maryland’s new website incorporates a more vibrant design, and offers a user-friendly format and interactive map for better navigation.

Redesign includes improvements to content and navigation with user-friendly dashboard and interactive map

New Carrollton, MD – A newly designed website now makes the Community Investment Tax Credit program more accessible to individuals and businesses who want to contribute to revitalization projects in Maryland neighborhoods.

Following on Governor Larry Hogan’s commitment to a more customer-oriented government, the Maryland Department of Housing and Community Development has revamped the website for GIVE Maryland. The new site can be found at www.givemaryland.org.

GIVE Maryland gives individuals and businesses the opportunity to search for and donate online to nonprofits that have available tax credits and are working in their own communities.

The newly revamped website incorporates a more vibrant design, and offers a user-friendly format and interactive map for better navigation. New dashboard features will help donors tailor their contributions based on their interests.

“GIVE Maryland’s new website will make charitable giving simpler and easier and strengthen our efforts to revitalize Maryland neighborhoods,” said Secretary Kenneth C. Holt. “By making a contribution, donors can reduce their state tax liability and help nonprofits make an impact in their own communities. It’s a win-win situation.”

Through Maryland’s Community Investment Tax Credit program, the housing and community development agency awards state income tax credits to 501(c)(3) nonprofit organizations and issues those tax credits to project donors. Individuals and businesses who donate $500 or more to a qualified organization’s approved project can earn state tax credits equal to 50 percent of the value of the contribution, in addition to regular federal and state charitable deductions.

For the very first time, donors have the opportunity to view how much tax credits have been awarded to each nonprofit, and how much is used and still available. New data is exported from the database and uploaded to Maryland’s Open Data Portal on a weekly basis.

On the homepage, donors can easily navigate GIVE Maryland’s site categories and find key information about the tax credit program. Additionally, they can learn about current projects in the Awardee Spotlight section, where participating nonprofits are recognized every month.

The new dashboard interface is a geographic information system based map that allows donors to search for nonprofits by panning and zooming on the map. Donors can narrow search results based on program type or project type from the dropdown menu. They can also view a list of their search results at the bottom of the dashboard, where a data table is connected to the interactive map and selection criteria.

The department’s partnership with the Maryland Department of Information Technology and the Eastern Shore Regional GIS Cooperative were vital to the successful completion of GIVE Maryland’s new website.

The Community Investment Tax Credit program has leveraged nearly $27 million in charitable contributions to approximately 700 projects across Maryland. The program complements other state community revitalization programs, like Community Legacy, which spurs reinvestment in existing communities.

Community Investment Tax Credit projects include education and youth services; housing and community development; job and self-sufficiency training; enhancing neighborhoods and business districts; arts, culture and historic preservation; economic development and tourism promotion; technical assistance and capacity building; and services for at-risk populations.

To learn more about the housing and community development department’s neighborhood revitalization programs, visit www.neighborhoodrevitalization.org.

###